Award-winning PDF software

Marketplace appeal forms | healthcare.gov

If you didn't file your appeal within the time limit, we'll automatically put it on hold. If you file an appeal after the deadline you must pay the fees again, and you'll lose your time to file your appeal.

Marketplace appeal forms | healthcare.gov

Extra: Please review and follow these rules, as they may be subject to changes in the future. To fill out a Marketplace Appeal, complete and submit the following information to the Marketplace at no expense to the consumer in accordance with the instructions found below. Please note, if you are an individual, and are not an applicant, you must complete all the form fields provided in accordance with their instructions. (1) Identity and address information (2) Your description of the service you are claiming for in the form (3) The product, service, or property involved in your claim (4) The amount and dollar amount of the disputed claim(s) (5) Details of how you intend to present the fact of the disputed claim(s) and your response to the Marketplace if applicable (6) The name(s) of anyone you need to consult with regarding the Marketplace process in accordance with.

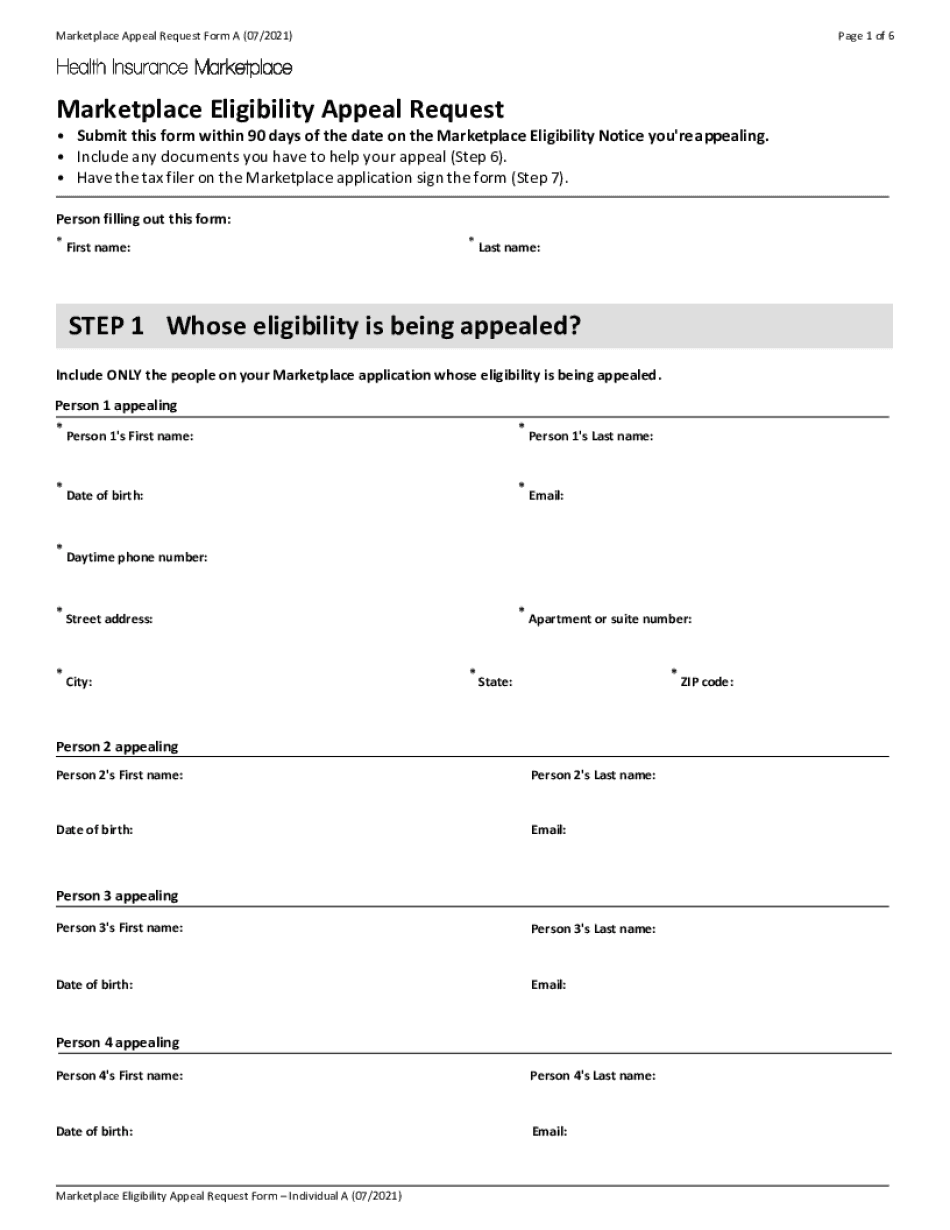

marketplace appeal request form a (07/) - healthcare.gov

How to apply for a Marketplace Plan Step 1. Go to the Marketplace and select “Your coverage in 2018”. Step 2. Choose from one of three Marketplace plans: • Bronze Step 3. Pay your monthly premiums, and receive a card. Click below and select the correct state: How long will it take for my application to be processed? The process will take approximately 6-8 weeks from the date your application is turned in to your state's Marketplace. The Marketplace can only process your Marketplace Plan from the date you submitted your application through the first day of the plan year, or from the date of the last Marketplace plan on which you qualify, whichever is shorter. Once an application is completed by you, it should become available to your state's Marketplace after the last days of January 2018. Can I opt out of a Marketplace Plan? Only the plan you applied for and received will.

marketplace-employer-appeal-form.pdf - healthcare.gov

If the document is an .exe, right-click this document. Then select “run as administrator” or “run” and type in “explorer” without the quote. The document in Explorer. Click the “Extract All” button to extract files from the folder. Select your desktop. In the left-hand side, click “Open”. If it is “Start up” select “Run”. Open the folder from the previous step. If there are files inside, right-click on the file named C:\WINDOWS\System32\Drivers\etc. Select “Extract All”. The extracted folder. Next, right-click again and select “Open Properties”. Navigate to the following tab: C:\WINDOWS\System32\Drivers\etc. Select the file “" and press OK. On the “Options” tab, click on “Startup Type”, select “Custom” and press Open. Then, on the “Advanced” tab, under “Startup type”, select “Windows Update”. Press OK. Click on “OK”. A window will appear to say that your system is now “startup configured”. A startup configured in.

How to file an appeal | healthcare.gov

Review the following guidelines: For all applications 1. Do not use Forms 1099-MISC, 1099-R, D, or AIR. Do not use these forms with Schedule A, line 21. 2. Do not use Forms 1099-MISC, 1099-R, D, or AIR with other forms. For all sales and use tax returns: 1. Do not use Form 1120, Sales and Use Tax Return, for all sales and use tax transactions. Instead, use Form 709 or Taxpayer Reference Guide: Sales and Use Tax — Information for Businesses. (See below.) 2. If you are a new taxpayer, do not use Forms 1120, 1120S, or 1120T. For all other sales and use tax returns: 1. Use Schedule A, line 21 for sales tax transactions. 2. If you are not a new taxpayer, and you make a sales or use tax payment, use Schedule C (Paid by Business; Other), line 21. 3. If you are not a new taxpayer, and you make a sales or use tax payment.